Our Case Studies that made an impact

Our industry expertise enables us to provide IT staffing solutions that connect you with skilled professionals who understand your market, technology stack, and growth goals. Whether you're scaling a new product or modernizing an existing system, our teams ensure fast onboarding and consistent results.

How We Built Hotel Booking Platform for Emergency Stay for US Social Services

How We Built the Complete Technology Stack for Swiss Startup

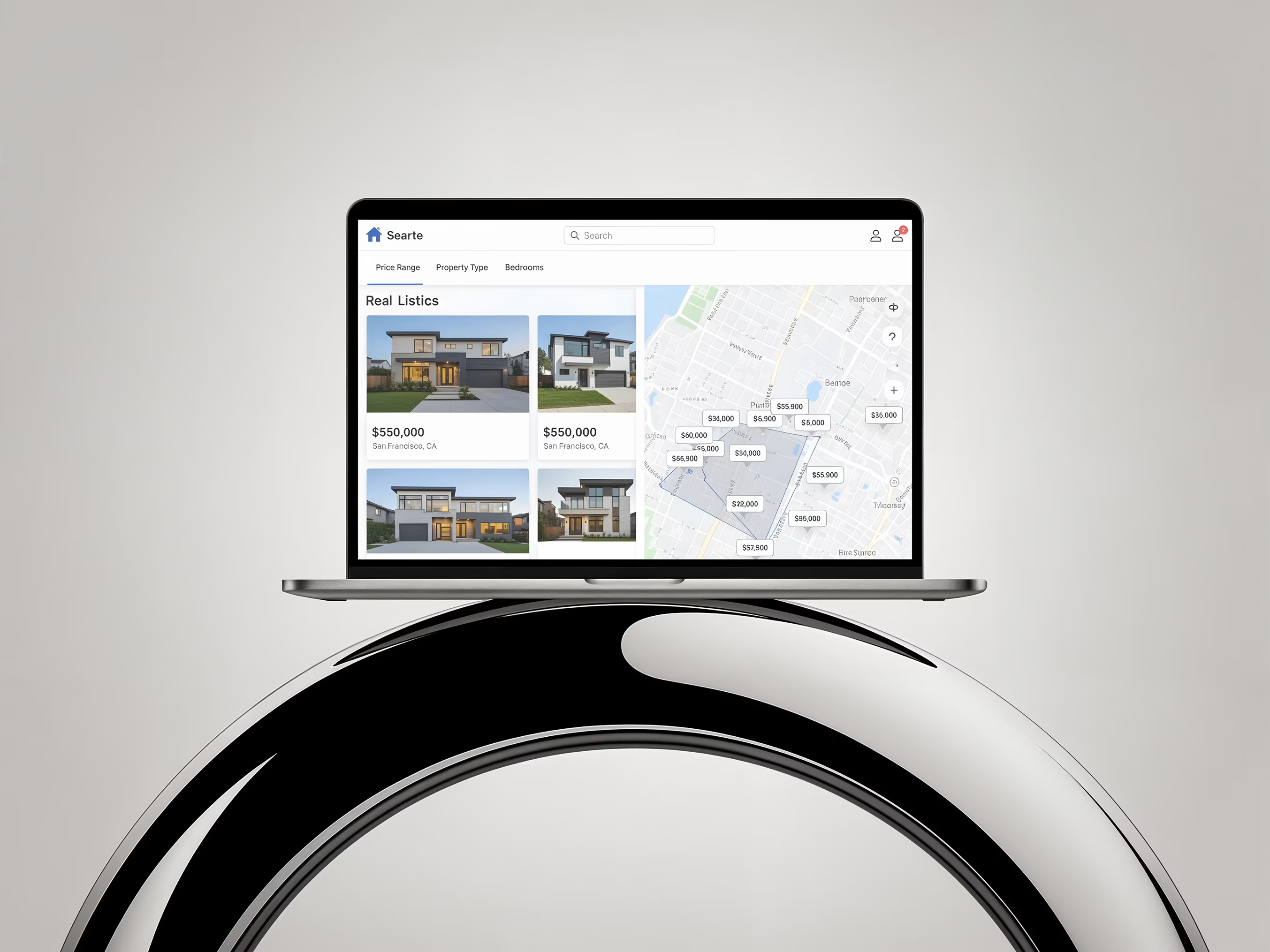

How We Built a Short-Term Furnished Housing Platform for Chicago-Based Startup

How We Built Swiss Electricity Tariff Transparency Platform in 1 Month

How We Built Instant Shelter Booking Platform for US Social Services